Vietnam is a country with immense tourism potential and has been attracting tourists from around the world. However, like many other countries, Vietnam’s tourism industry was significantly affected by the COVID-19 pandemic. The Statista report provides valuable insights into the tourism market in Asia, with a specific focus on Vietnam, offering detailed data on the industry’s performance.

Overview

- According to the report, China ranked first in terms of international tourist arrivals in Asia, with 33.28 million visitors in 2020. Thailand secured the second position with 14.86 million arrivals, followed by Japan with 9.17 million. Vietnam ranked sixth with 6.83 million arrivals.

- In 2021, due to the pandemic, international visitor arrivals in Vietnam were estimated at 157.3 thousand, a staggering 95.9% decrease compared to the previous year. However, the number of domestic tourists reached approximately 40 million, and the total revenue from tourism amounted to VND 180,000 billion.

Key Performance Indicators

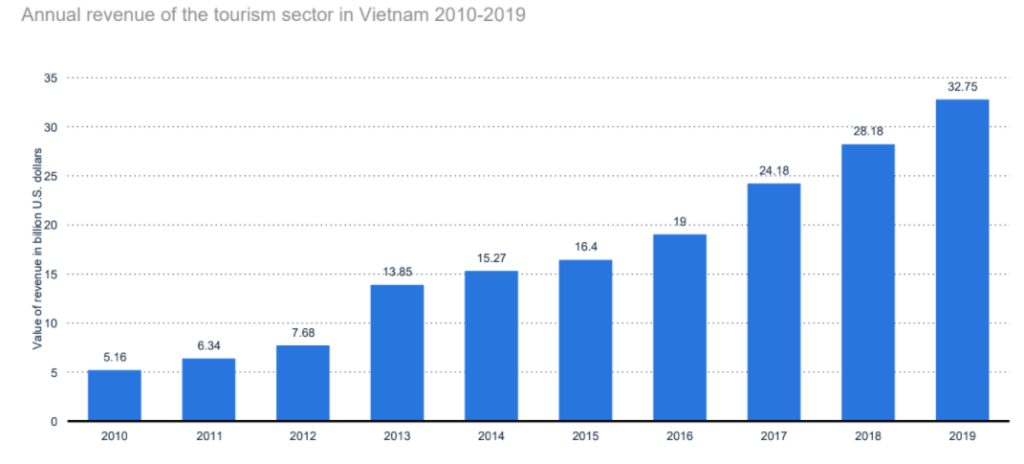

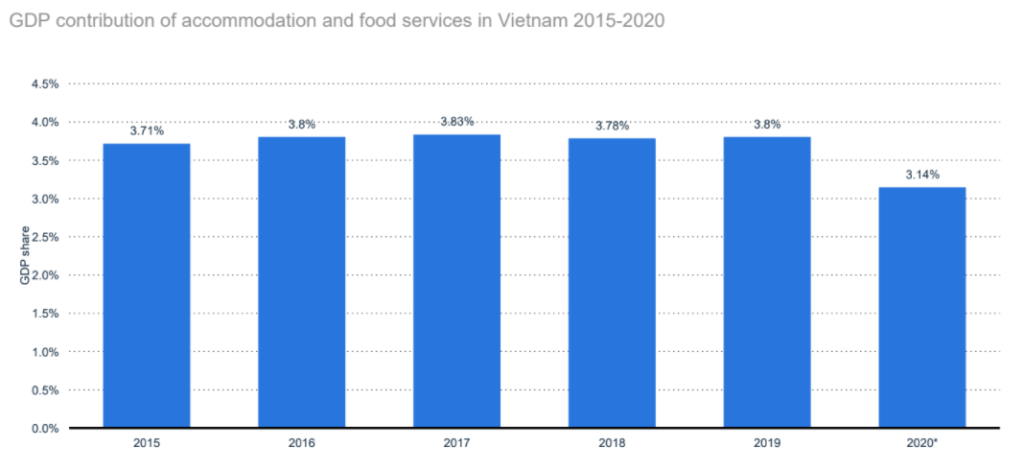

- The share of direct GDP contribution from the tourism sector in Vietnam has shown a steady increase from 2015 to 2019. In 2019, the annual revenue from the tourism sector reached $32.75 billion, representing a growth of $4.57 billion compared to the previous year.

- Despite the challenges faced in 2021 due to the pandemic, the tourism industry’s contribution to GDP remains significant. Industries such as manufacturing, wholesale and retail trade, and agriculture also contribute significantly to the country’s economy.

International Tourism

- In 2020, the number of international visitor arrivals in Vietnam was 3.83 million, marking a significant decrease of 14.17 million compared to the previous year. Of these arrivals, 81% were transported by air, 16% by road, and 3% by sea.

- China and South Korea were the leading sources of international tourists in Vietnam, with over 1.8 million arrivals (50% of the total) from these countries. Other significant sources of international visitors included the United States, Canada, and various European countries.

- The average daily expenditure of international tourists in Vietnam was $117.8 in 2019, reflecting a 22.7% increase compared to the previous year. Overnight visitors, including those on package tours and self-arranged trips, stayed for approximately 8 days at commercial accommodations, while non-commercial accommodations saw an average stay of around 12 days.

Domestic Tourism

Domestic tourism in Vietnam has shown steady growth over the years, with 157.73 million domestic tourist arrivals in 2019, compared to 144.68 million in 2018 and 133.84 million in 2017. In 2019, domestic tourists spent an average of 1,223 thousand VND per day, lower than the average in 2018. Both commercial and non-commercial accommodations witnessed an average stay of around 4 days for domestic tourists.

Accommodation Industry

Vietnam boasts approximately 30,000 tourist accommodations with over 100,000 rooms nationwide as of the end of 2019. Several destinations, including Da Nang, Hoi An, Nha Trang, and Phu Quoc, have witnessed the establishment of world-class international luxury resorts. The average rates for 5-star and 4-star hotels in Vietnam increased slightly in 2019 compared to the previous year. The majority of guests staying in upscale hotels were international visitors.

Tour Operators and Guides

Vietnam is home to a significant number of tour operators, with 2,670 operators by the end of 2019, reflecting an increase compared to the previous year. The country also has 7,680 licensed tour guides, with English being the most commonly spoken language followed by Chinese and French. However, there is a shortage of guides proficient in languages such as Korean, Japanese, and Russian, particularly during peak seasons.

Online Travel Agencies

- Online travel agencies (OTAs) are gaining prominence in Vietnam, although they are still relatively new compared to global markets. A survey conducted in November 2020 indicated that 60% of Vietnamese respondents had used an OTA, while 8% were unaware of this service.

- Leading OTAs in Vietnam, based on the survey results, include Booking.com, Agoda, Traveloka, Trivago, TripAdvisor, Airbnb, Skyscanner, Expedia, Tugo, and others. The majority of users prefer booking through smartphones, followed by laptops and tablets. Developing mobile-friendly websites is crucial for OTAs to attract users and improve conversion rates.

Impact of COVID-19

The tourism industry faced immense challenges during the pandemic, with travel restrictions and lockdown measures implemented globally. In Vietnam, international visitor arrivals experienced a significant decline, and the hotel occupancy rate dropped by 32% in the first half of 2020 compared to the previous year.

In conclusion, the key points summary is as follows:

- Vietnam’s tourism industry experienced a decline in international visitor arrivals due to the COVID-19 pandemic.

- The tourism sector’s contribution to Vietnam’s GDP has shown steady growth, with increasing annual revenues.

- China and South Korea were the leading sources of international tourists visiting Vietnam.

- Domestic tourism in Vietnam has been steadily growing, with significant expenditure from domestic tourists.

- The accommodation industry in Vietnam offers a wide range of options, with luxury resorts in popular destinations.

- Tour operators and licensed guides play a crucial role in facilitating tourism experiences for visitors.

- Online travel agencies are gaining popularity in Vietnam, with leading global and local players competing in the market.

Despite the challenges posed by the pandemic, the tourism industry in Vietnam is expected to recover and flourish in the coming years. Contact our Vietnam team for comprehensive support and guidance in navigating the tourism market and exploring opportunities in this dynamic sector.

Leave a Reply