The ride-hailing market in Vietnam has experienced rapid growth and intense competition in recent years. With the emergence of technology and smartphone applications, ride-hailing services have become increasingly popular and convenient. This article will provide an overview of the ride-hailing market in Vietnam based on the Ride-hailing Market in Vietnam Report from Statista.

Overview:

- Globally, the ride-hailing market saw significant growth, with its value increasing from 75.39 billion USD to 117.34 billion USD in 2021 compared to 2020. In Southeast Asia, the internet economy reached 62 billion USD in 2020, with online media, online travel, and transportation and food sectors contributing 17 billion USD, 14 billion USD, and 11 billion USD, respectively.

- Indonesia leads the online ride-hailing market in Southeast Asia, with a market value of 5 billion USD in 2020. Vietnam follows with a market value of 1.6 billion USD, and other countries such as Singapore, Thailand, Malaysia, and the Philippines also show substantial market value.

Key Indicators:

- The revenue of the ride-hailing and taxi segment in Vietnam experienced slight fluctuations, increasing from 2.6 million USD in 2017 to 3.1 million USD in 2019 before falling to 2.1 million USD in 2020 due to the impact of the COVID-19 pandemic. However, in response to the pandemic, many ride-hailing companies expanded their services to include delivery and household services, leading to an expected revenue increase to 3.115 million USD in 2021 and further growth to 4.5 million USD by 2025.

- The ride-hailing and taxi market in Vietnam primarily operates offline, but there is a growing trend of moving towards online platforms.

Leading Platforms:

Grab remains the dominant ride-hailing platform in Vietnam, capturing 73% of the market share in 2019. Be and Gojek follow with 16% and 10% market shares, respectively. Other platforms such as MyGo, FastGo, and VATO also contribute to the ride-hailing market in Vietnam.

Popular Ride-Hailing Apps:

Grab, Gojek, and Behave faced challenges in 2020 due to the impact of the COVID-19 pandemic. Grab witnessed a significant decrease in the number of rides, from 313 million rides in H1 2019 to 62.5 million rides in H1 2020.

Bike Ride-Hailing:

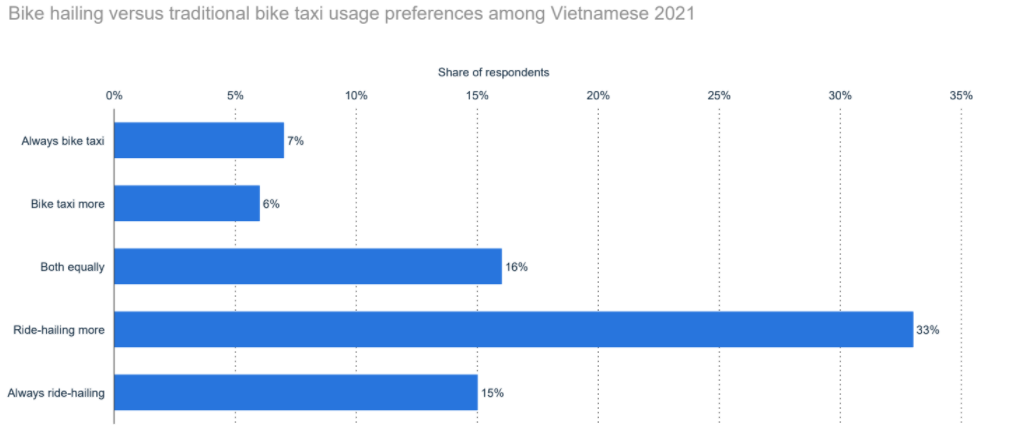

Bike ride-hailing services are preferred by 33% of respondents, while only 6% prefer traditional bike taxis. The reasons for choosing bike ride-hailing include easy app-based ordering, clear cost structure, affordability, quick payment, promotions, clear destination information, and convenience in catching rides.

Car Ride-Hailing:

Car ride-hailing services are favored by 38% of respondents, while 14% still prefer traditional taxis. The reasons for choosing car ride-hailing include easy app-based ordering, clear cost structure, affordability, quick payment, promotions, and convenience in catching rides. However, traditional taxis are preferred by some due to ease of catching, price considerations, car quality, and the absence of ride-hailing apps.

In conclusion, the development of ride-hailing applications in Vietnam has transformed the functioning of the traditional bike and taxi market. However, the global pandemic that emerged in late 2019 had a significant impact on the ride-hailing industry both internationally and in Vietnam. In response to the pandemic and changing consumer needs, ride-hailing services shifted from transporting people to delivering goods. Additionally, there was a shift towards prioritizing cashless payment methods such as credit cards and e-wallets, replacing traditional cash transactions. These adaptations aimed to ensure safety and improve the survival of ride-hailing services during the challenging period of the pandemic.

Key Points Summary:

- The ride-hailing market in Vietnam has witnessed rapid growth and intense competition.

- Globally, the ride-hailing market has seen significant value growth, with Southeast Asia showing promising market potential.

- The revenue of the ride-hailing and taxi segment in Vietnam fluctuated due to the COVID-19 pandemic but is expected to recover and grow in the coming years.

- Grab is the leading ride-hailing platform in Vietnam, followed by Be and Gojek.

- Bike ride-hailing services are preferred by a significant portion of the population, primarily due to their convenience and affordability.

- Car ride-hailing services are gaining popularity, although some individuals still prefer traditional taxis.

- The COVID-19 pandemic has had a notable impact on the ride-hailing market, leading to changes in user behavior and a decrease in the number of rides.

For comprehensive assistance and guidance in navigating the ride-hailing market in Vietnam, contact our Vietnam team. We can provide expert advice and support to help your business succeed in this dynamic and competitive industry.

Leave a Reply