The online travel industry has witnessed substantial growth opportunities in the era of the Fourth Industrial Revolution and global integration. However, the COVID-19 pandemic had a negative impact on tourism businesses worldwide, including Vietnam. Despite this challenge, online travel agencies (OTAs) have emerged and achieved significant milestones during the pandemic. This article provides an overview of the global and Vietnamese OTA market in 2020, as well as forecasts until 2025.

I.Overview

According to Statista, the global online travel agent sector reached a market size of $432.14 billion in 2020. This number is projected to increase to $561.36 billion in 2021. In Vietnam, the online travel market’s gross merchandise value reached $3 billion in 2020, equivalent to Indonesia in the Asia Pacific region and trailing behind Thailand ($4 billion).

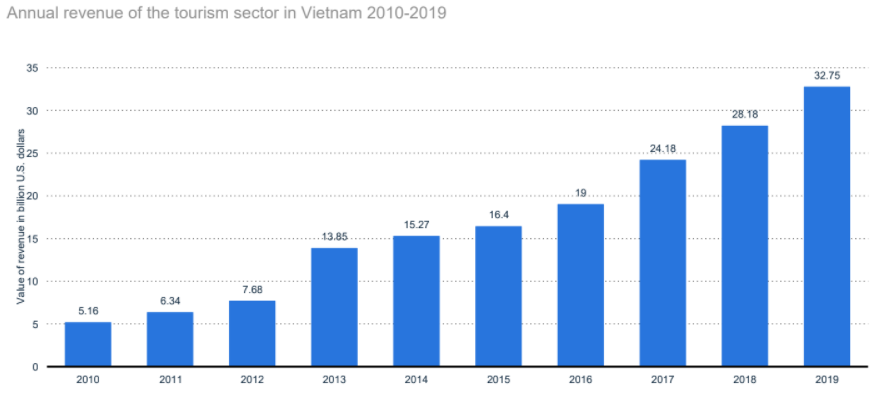

The tourism industry in Vietnam experienced a breakthrough in 2019, generating a total revenue of VND 720 trillion ($32.75 billion) with a growth rate of 16.2% compared to 2018. It contributed 9.2% to the country’s GDP and was recognized by the World Tourism Organization (UNWTO) as one of the top 10 countries with the fastest tourism growth. The online travel segment played a significant role in this success.

II.Key Indicators

Vietnam successfully tested a 5G broadband network in 2019 and commercialized it in 2020, providing favorable conditions for online travel businesses. However, the global pandemic and subsequent travel restrictions led to a decline in revenue for the online travel sector in Vietnam. According to Statista, online travel revenue in Vietnam reached $578.24 million in 2020, a decrease of over $773 million compared to the previous year.

Despite the challenges posed by the pandemic, Vietnam is forecasted to recover and experience significant growth in the coming years. The revenue is expected to grow at a rate of 31.31% per year from 2021 to 2025.

III.Usage of OTAs

A survey conducted in November 2020 among 2,614 Vietnamese individuals revealed that 60% of respondents were aware of and used an online travel agent, while 32% did not use such services and 8% were unfamiliar with them. Among online booking users, 40% traveled at least three times per year, 39% traveled twice per year, and 21% traveled once per year.

The digital transformation brought about significant changes in Vietnam’s travel consumption trends over the past decade. Cash payments have been replaced by online methods such as credit/debit cards and e-wallets. Booking services for flights, hotels, and other travel needs through smartphone applications have witnessed a significant increase.

The survey further revealed that 70% of respondents used online travel agencies to book accommodation, 57% to purchase flight/train/bus tickets, 38% to book other travel services (sightseeing tours, tour guides, etc.), 33% to book package holidays, 26% for trip research purposes, 22% to rent a car, and 1% for other purposes.

IV.Leading OTAs

Currently, foreign brands dominate the online travel market in Vietnam for services such as air ticket and hotel bookings. Prominent OTAs include Agoda, Traveloka, Booking.com, and TripAdvisor. Vietnamese OTAs such as VNTrip, Vinabooking, and Mytour also play a role but with lesser prominence. According to Statista, the most widely used OTAs in Vietnam in 2020 were Booking.com (62%), Agoda (61%), Traveloka (45%), Trivago (32%), TripAdvisor (28%), Airbnb (14%), Skyscanner (11%), Expedia (9%), Tugo (4%), and others (3%).

V.Consumer Preferences

A survey conducted in June 2021 among 319 Vietnamese individuals revealed that 51% preferred to use both travel agencies and online booking platforms for hotel reservations, 37% preferred online booking, and 12% preferred travel agencies. A similar trend was observed for package travel, with 60% using both travel agencies and online booking platforms, 25% preferring travel agencies, and 14% preferring online booking. Regarding flight bookings, 50% of respondents used both travel agencies and online platforms, 35% preferred online booking, and 15% preferred travel agencies.

The survey also highlighted that 45% of respondents chose online travel agencies for their easy discoverability through search engines, 41% appreciated their user-friendly websites, and 41% were attracted by good prices and promotions.

VI.Impacts of COVID-19

The COVID-19 pandemic severely impacted the tourism industry worldwide, including Vietnam. Travel restrictions and social distancing measures led to a significant decrease in international tourist arrivals in Vietnam, with a decline of 78.7% compared to the previous year. The number of tourists by air decreased by 78.6%, by road by 81.9%, and by sea by 45.2%. Tourist attractions were temporarily closed, and domestic and international tourists canceled their travel plans.

In conclusion, the key points summary is as follows:

- The global online travel agent sector has experienced significant growth, with a market size of $432.14 billion in 2020.

- In Vietnam, the online travel market reached a value of $3 billion in 2020, contributing to the country’s tourism industry.

- Despite the challenges posed by the COVID-19 pandemic, Vietnam’s online travel sector is expected to recover and grow at a rate of 31.31% per year from 2021 to 2025.

- Online travel agencies are widely used in Vietnam for various purposes, including accommodation booking, flight ticket purchases, and other travel services.

- Foreign brands dominate the online travel market in Vietnam, but local OTAs also play a significant role.

- Consumer preferences vary, with many individuals preferring a combination of travel agencies and online booking platforms for their travel needs.

- The COVID-19 pandemic had a severe impact on the tourism industry, leading to a decline in international tourist arrivals and temporary closures of tourist attractions.

Contact our Vietnam team for comprehensive support and guidance in navigating the online travel market. We are here to assist individuals and businesses in achieving their travel goals and leveraging the opportunities in Vietnam’s online travel industry.

Leave a Reply