The insurance industry in Vietnam has witnessed significant growth and development in recent years, playing a vital role in the country’s financial landscape. As of 2021, the financial, banking, and insurance sector in Vietnam has become a significant contributor to the country’s GDP, with steady increases in revenue and the establishment of new businesses. This article presents key insights from the Insurance in Vietnam Report for 2020-2021, shedding light on the current state of the insurance market and highlighting the trends and opportunities within the industry.

Overview:

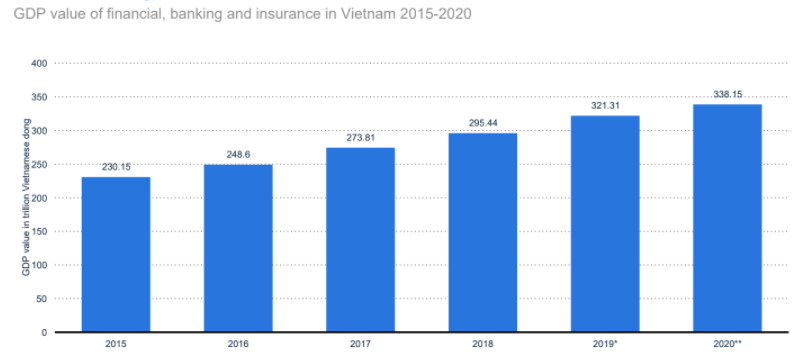

The financial, banking, and insurance sector in Vietnam has experienced remarkable growth, with its GDP contribution reaching approximately 5.5% from 2015 to 2020. This upward trend reflects the increasing importance of the sector in driving economic growth. In 2020, the GDP value amounted to 338.15 trillion VND, showing a significant increase of 153% compared to 2015.

Within the insurance industry, non-life insurance has emerged as a dominant sector in Vietnam. From 2011 to 2019, the premium per capita for insurance tripled, indicating the growing awareness and demand for insurance products among the population. Notably, non-life insurance premium revenue more than doubled during this period, reaching 53.37 trillion VND in 2019.

Non-Life Insurance:

Health insurance and auto insurance are the leading segments within the non-life insurance sector in Vietnam. In 2019, these two categories accounted for the highest proportion of premiums, surpassing 16,000 billion VND. Other segments such as property and casualty insurance, fire and explosion insurance, cargo insurance, and liability insurance also contributed significantly to the non-life insurance market.

With a young and large population structure, Vietnam presents immense potential for the non-life insurance sector. The rise of the middle class and increased property and vehicle ownership levels further amplify the need for insurance coverage. Despite a non-life insurance penetration rate of 0.88% in 2019, indicating room for growth, the market has shown positive signs of expansion.

Life Insurance:

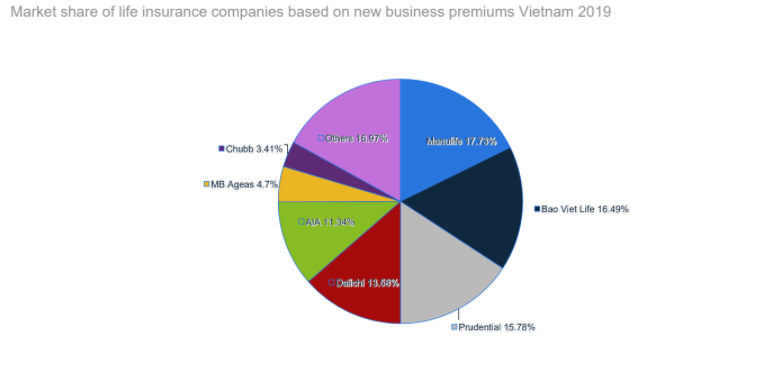

Life insurance has also experienced substantial growth in Vietnam. The total premium revenue reached 106.64 trillion VND in 2019, representing a significant increase of 123.7% compared to the previous year. Leading life insurance companies such as Bao Viet Life, Prudential, and Manulife have captured significant market share and contributed to the sector’s growth.

Social Insurance:

Social insurance plays a crucial role in providing social security to the Vietnamese population. Total social insurance revenue has steadily increased from 2016 to 2020, with some fluctuations due to the impact of the pandemic. Despite the challenges, social insurance coverage remained strong, with approximately 16.4% of the population benefiting from social insurance in 2019.

Health Insurance:

Health insurance coverage in Vietnam has seen remarkable progress, with a significant increase in revenue and the number of participants. In 2019, the total health insurance revenue amounted to 103.85 trillion VND, indicating a rise of 9.12 trillion VND compared to the previous year. The coverage reached an impressive rate of 88.89% of the population participating in health insurance.

Unemployment Insurance:

Unemployment insurance has also gained prominence in Vietnam, providing financial support to individuals during challenging times. In 2019, the total revenue from unemployment insurance was 22.14 trillion VND, supporting a growing number of participants. The pandemic caused a slight decrease in revenue in 2020 but did not diminish the importance of unemployment insurance in ensuring economic stability.

In conclusion, the insurance market in Vietnam has demonstrated robust growth and resilience, contributing significantly to the country’s financial sector.

- The financial, banking, and insurance sector in Vietnam has contributed significantly to the country’s GDP, with a steady increase in revenue and the establishment of new businesses.

- Non-life insurance has emerged as a dominant sector in Vietnam, with health insurance and auto insurance accounting for the highest proportion of premiums.

- The premium per capita for insurance has tripled from 2011 to 2019, indicating a growing awareness and demand for insurance products among the population.

- Life insurance has experienced substantial growth, with leading companies capturing significant market share and contributing to the sector’s expansion.

- Social insurance provides vital social security, with approximately 16.4% of the population benefiting from coverage.

- Health insurance coverage has seen remarkable progress, reaching a rate of 88.89% of the population participating in health insurance.

- Unemployment insurance plays an essential role in providing financial support during challenging times, with a growing number of participants.

- The insurance market in Vietnam presents ample opportunities for insurers, fueled by increasing awareness, the rise of the middle class, and a young and large population.

As Vietnam’s economy continues to flourish, the insurance market presents ample opportunities for local and international insurers to expand their operations. Contact our Vietnam team for personalized support and guidance in the insurance market.

Leave a Reply