The Fintech industry in Vietnam has experienced significant growth, particularly in the e-wallet sector, driven by the impact of the pandemic and the increasing adoption of digital payment methods. Vietnam has emerged as one of the countries with the highest electronic payment growth globally, with an annual growth rate of 30.2% projected for the period 2020-2027. In this article, we will delve into the Vietnam e-wallet market, exploring its growth, user penetration, leading e-wallet brands, and user behavior.

Overview:

According to the E-wallets in Vietnam report, the transaction value of digital payments in Asia has witnessed a rapid increase from 2017 to 2025. In 2021, the transaction value surpassed 2,200 million US dollars, doubling compared to 2017. The report also predicts that the transaction value is expected to exceed 3,000 million US dollars by 2025. Despite this growth, Vietnam ranked 8th in the list of countries in the Asia Pacific region in terms of the transaction value of digital payments in 2020. However, the country has demonstrated immense potential for further development.

Users and Penetration:

The adoption of digital payment methods in Vietnam has gained significant traction. In a research study conducted in 2021, internet banking was the most commonly used online transaction method, with 70% of respondents utilizing it. Cash on delivery, ATM card/bank transfer, and e-wallets were also popular choices, with respective adoption rates of 63%, 61%, and 59%. Major cities in Vietnam showed higher e-wallet usage, with 64% of respondents in Hanoi and 68% in Ho Chi Minh City utilizing e-wallets. The number of mobile wallet users in Vietnam reached 19.2 million in 2020 and is projected to reach 57 million by 2025.

Leading e-wallets:

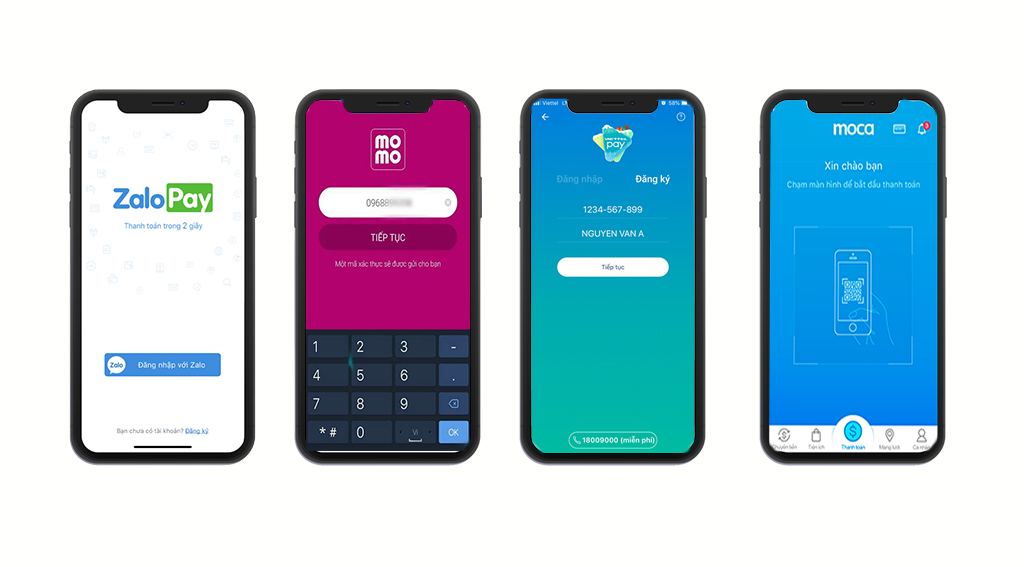

The Vietnamese market has seen intense competition among financial technology companies, resulting in the launch of numerous e-wallet brands. Among the plethora of options, six prominent e-wallet brands have emerged: Momo, ZaloPay, ViettelPay, Shopee Pay, Moca, and VNPTPay. According to Statista, Momo holds the largest market share in the mobile wallet segment, accounting for 53% in 2020. Other popular brands include ViettelPay (25.2%), AirPay (10.6%), ZaloPay (5.3%), and GrabPay (2%).

User Behavior:

Vietnam ranks among the top three countries globally in terms of mobile payment application usage, with a market share of 29.1% as per the World Bank survey. The convenience and safety offered by e-wallets have prompted frequent usage, with 35% of users utilizing e-wallets 3-5 times per week and 21% using them daily. Additionally, the survey reveals that 24% of respondents spend between 100,000 to 500,000 VND, 23% spend between 500,000 to 1,000,000 VND, and 14% spend between 1,000,000 VND to 1,500,000 VND.

In conclusion, in light of the rapid growth of financial technology and the increased demand for e-wallets influenced by the pandemic, businesses aiming to thrive must capitalize on this opportunity by swiftly integrating mobile payment solutions. By doing so, they can not only retain existing customers but also attract new ones. The adoption of mobile payment integration has become crucial for businesses seeking success in today’s digital landscape.

Key takeaways from the report include:

- Rapid growth in the transaction value of digital payments, with the projection of surpassing 3,000 million US dollars by 2025.

- High user penetration, particularly in major cities, with the number of mobile wallet users expected to reach 57 million by 2025.

- Dominance of leading e-wallet brands such as Momo, ZaloPay, ViettelPay, Shopee Pay, Moca, and VNPTPay.

- Frequent usage and diverse spending patterns among e-wallet users, highlighting the convenience and popularity of these payment methods.

The e-wallet market in Vietnam has experienced significant growth and shows immense potential for further development. To navigate the dynamic e-wallet market and leverage its potential for your business, contact our Vietnam team. Our experts are ready to provide support and guidance in capitalizing on the opportunities offered by the thriving e-wallet ecosystem in Vietnam.

Leave a Reply