Fintech, the fusion of technology and financial services, has witnessed remarkable growth in Vietnam in recent years. The number of operating fintech companies in the country has doubled from 78 in 2016 to 141 in 2020, as per Statista’s report. This article will delve into the Vietnam Fintech Report for 2021, analyzing the current state of the domestic fintech sector, highlighting industry trends, and exploring the local fintech startup ecosystem in the Asia Pacific.

Overview:

According to Statista’s report, the total value of fintech investments in the Asia Pacific region tripled from 13.6 billion US dollars in 2017 to 36.6 billion US dollars in 2018. However, the subsequent years witnessed a decline, with investments totaling 16.8 billion US dollars in 2019 and 11.6 billion US dollars in 2020.

Vietnam’s transaction value of digital payments in 2020 stood at 8.6 billion US dollars, ranking below countries like China, India, Australia, Indonesia, Singapore, Hong Kong, and Malaysia. Nevertheless, the fintech sector in Vietnam has exhibited rapid growth, with the transaction value projected to reach 26.4 billion US dollars by 2025.

Companies and Startups:

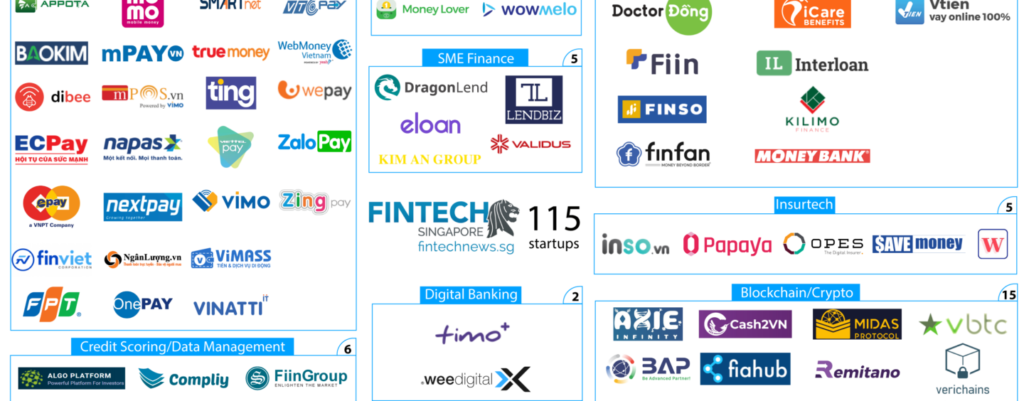

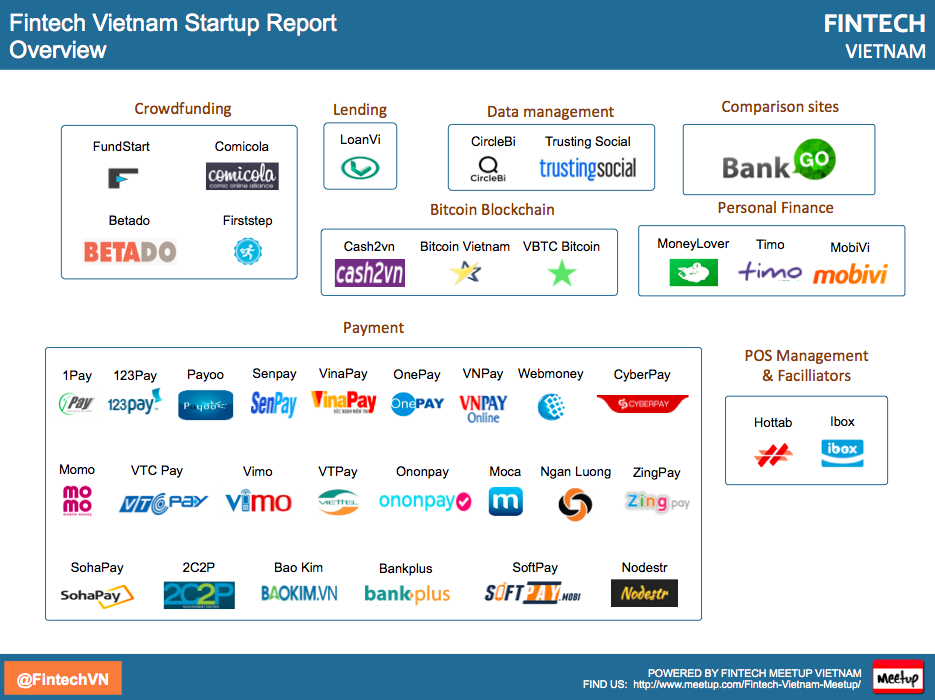

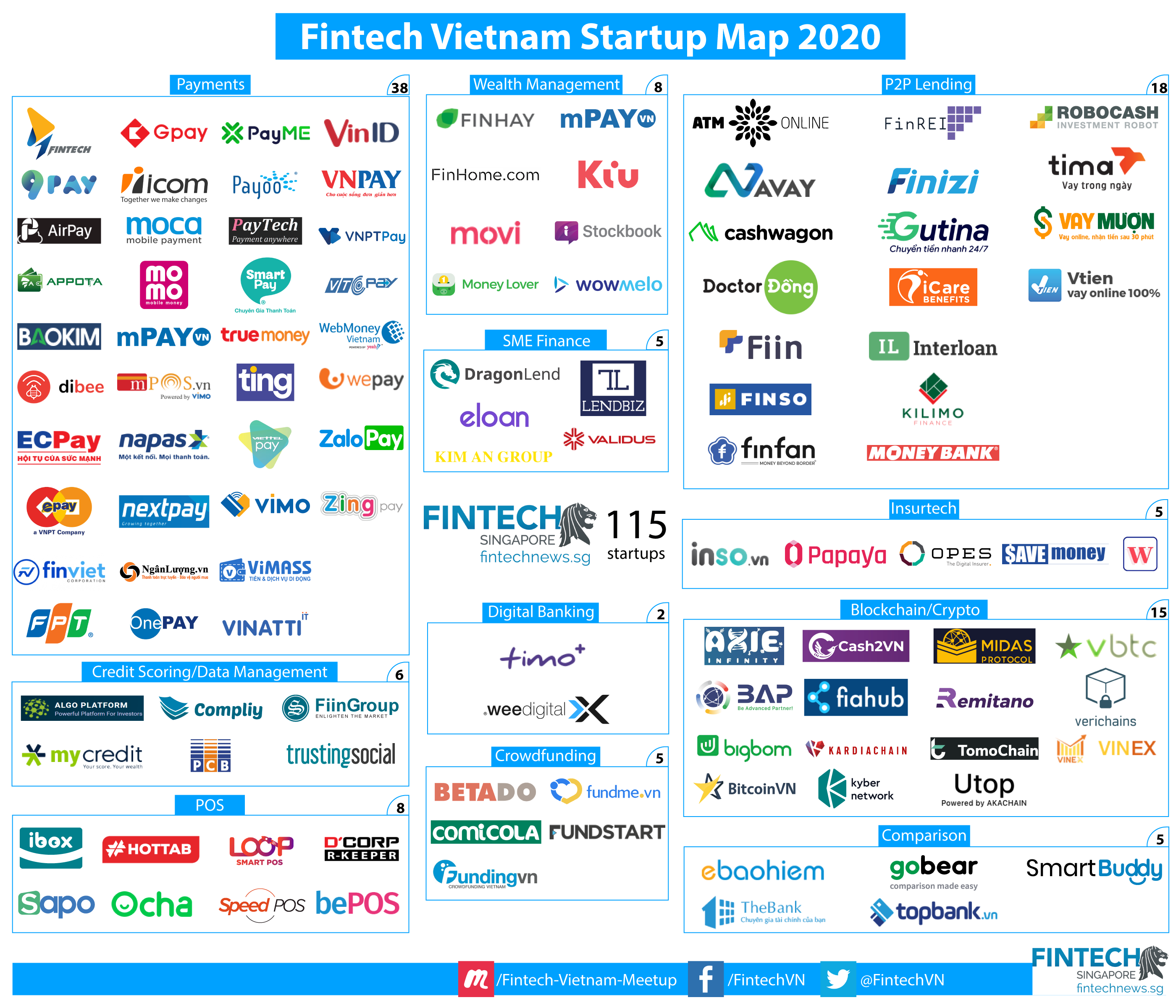

The number of fintech companies in Vietnam has seen consistent growth. In 2015, there were only 67 companies, which increased to 94 in 2017 and further expanded to 141 in 2020. These companies primarily cater to two main groups: end-users/individual investors and “back-office” companies providing technical support to financial institutions. Payment solutions account for the majority (31%) of fintech startups in Vietnam, followed by peer-to-peer lending (17%), blockchain/crypto (13%), POS (7.5%), wealth management, comparison, credit scoring/data management (5%), crowdfunding (4%), insurtech (4%), digital banking (3%), and SMEs financing (2%).

Digital Payment:

Vietnam has witnessed a steady increase in the transaction value of digital payments from 2017 to 2021. In 2021, the transaction value reached 12,922 million US dollars, projected to reach 22,056 million US dollars by 2025. The top five e-wallets in Vietnam include MoMo, Payoo, Moca, ZaloPay, and ViettelPay. The transaction value of e-wallets in Vietnam is predicted to reach 10.4 billion US dollars in 2019, with mobile banking transactions totaling 240 billion US dollars in the same year. The number of digital commerce payment users is expected to increase from 51.8 million in 2021 to 70.9 million in 2025, with an average transaction value per user decreasing from 257.9 US dollars in 2017 to 219 US dollars in 2020.

Alternative Lending:

The rise of fintech and the 4.0 technology revolution have posed challenges to the traditional banking sector. The alternative lending segment in Vietnam comprises crowdlending and marketplace lending. The transaction value in crowdlending increased by 50% from 0.6 million US dollars in 2017 to 0.9 million US dollars in 2020, while marketplace lending remained at 0.1 million US dollars. The number of loans in alternative lending remained relatively stable, with an average funding per loan of 0.6 US dollars in crowdlending and 0.1 US dollars in marketplace lending.

Crowdfunding and Crowdinvesting:

Crowdfunding transactions in Vietnam reached approximately 1.6 million US dollars in 2017, surpassing 1.9 million US dollars in 2020. The transaction value is predicted to grow by 137% and reach 2.6 million US dollars by 2025. Similarly, crowdinvesting transactions amounted to 0.1 million US dollars in 2017, rising to 0.4 million US dollars in 2021, and forecasted to reach 0.6 million US dollars by 2025. The average funding per crowd investment increased significantly from 67,663 US dollars in 2017 to over 133,000 US dollars in 2021.

Consumer Perspective:

The report reveals that over 47% of surveyed individuals in Vietnam were familiar with digital borrowing, 39% with digital money, and 36% with digital lending. Men tend to adopt e-banking and e-payment services more than women, while acceptance of e-transfer services is higher among females. Individuals with higher incomes (above 190 million VND) were three times more likely to accept fintech services compared to the middle-income group (85-190 million VND) and seven times more likely than the low-income group (below 85 million VND).

To conclude, the Vietnam Fintech Report for 2021 provides valuable insights into the dynamic fintech landscape of the country. Vietnam presents a promising environment for fintech innovation and investment. The sector has witnessed significant growth, with the number of operating fintech companies doubling in recent years.

Key Points Summary:

- The number of fintech companies in Vietnam has doubled, reflecting the sector’s growth.

- Digital payments and e-wallet adoption are on the rise.

- Alternative lending, crowdfunding, and crowdinvesting offer new financing options.

- Vietnam provides a favorable environment for fintech innovation and investment.

- Stay informed and take advantage of the opportunities in Vietnam’s thriving fintech industry.

For expert guidance and support in navigating Vietnam’s fintech landscape, feel free to contact our Vietnam team any time!

Leave a Reply